As Indian equity markets gear up for the trading session on April 24, 2025, investors are closely analyzing global cues, domestic triggers, and technical indicators to gauge the trajectory of the Nifty 50 and Sensex. With mixed signals from international markets and key domestic developments in play, here’s a comprehensive outlook on what traders and long-term investors should watch.

Pre-Market Snapshot: Global and Domestic Cues

- Global Markets:

- Wall Street: The Dow Jones and S&P 500 closed flat on April 23, 2025, amid caution ahead of the U.S. Federal Reserve’s policy meeting. NASDAQ dipped 0.3% due to profit-booking in tech stocks.

- Asian Open: Japan’s Nikkei rose 0.6% early, while Hang Seng futures signaled a muted start over China’s growth concerns.

- Commodities: Brent crude traded near 88/barrel∗∗afterOPEC+extendedsupplycuts.Goldsteadiedat∗∗88/barrel∗∗afterOPEC+extendedsupplycuts.Goldsteadiedat∗∗2,350/oz as Middle East tensions eased.

- Domestic Triggers:

- Q4 Earnings: HDFC Bank, Reliance Industries, and Infosys reported robust earnings, lifting sentiment.

- RBI Policy Minutes: Dovish remarks from central bank officials hint at a potential rate cut in Q2 2025.

- FII/DII Activity: Foreign institutional investors (FIIs) turned net buyers (+₹1,200 crore) on April 23, while domestic institutional investors (DIIs) sold ₹780 crore.

Technical Analysis: Nifty 50 and Sensex Levels to Watch

- Nifty 50 (Previous Close: 23,800):

- Support: 23,600 (20-DMA), 23,450 (Trendline Support).

- Resistance: 24,000 (Psychological Level), 24,200 (All-Time High).

- Outlook: A break above 24,000 could trigger short-covering; failure may lead to consolidation.

- Sensex (Previous Close: 78,500):

- Support: 78,000 (50-DMA), 77,600 (Key Fibonacci Level).

- Resistance: 79,000, 79,500.

- Chart Pattern: Bullish flag formation suggests upward momentum if global risks subside.

Key Factors Influencing Today’s Trade

- US Fed Policy Uncertainty:

With the Fed’s May 1 meeting in focus, any hawkish signal on inflation could spurt volatility in emerging markets, including India. - Corporate Earnings Momentum:

Stocks like Axis Bank, Maruti Suzuki, and TCS will react to their Q4 results. Strong guidance may drive sectoral rallies. - Geopolitical Developments:

Easing Iran-Israel tensions and stable oil prices reduce downside risks for energy-heavy indices. - Sector-Specific Trends:

- Banking: Improved NPA ratios and credit growth could lift HDFC Bank, ICICI Bank.

- IT: Weakness in NASDAQ may cap gains in Infosys, TCS despite strong earnings.

- Auto: EV-focused stocks like Tata Motors and M&M could rally on policy tailwinds.

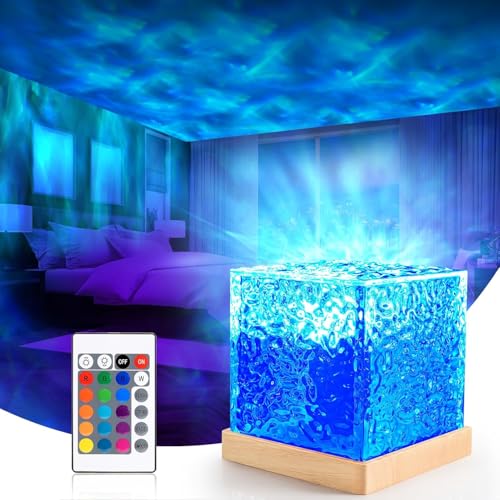

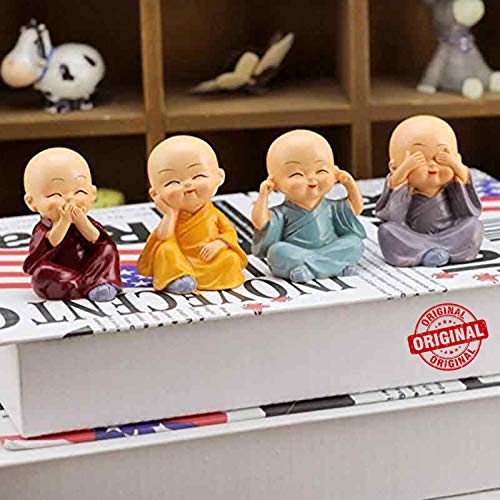

Bestseller #1

Bestseller #2

Bestseller #3

Bestseller #4

Bestseller #5

Bestseller #6

Bestseller #7

Derivatives Data: What F&O Signals Indicate

- Nifty 50: Highest Open Interest (OI) at 24,000 Call and 23,600 Put suggests a range-bound session.

- Bank Nifty: OI buildup at 52,000 Call (Resistance) and 51,000 Put (Support).

- FII Positions: Net long positions in index futures rose to 72%, indicating cautious optimism.

Stocks in Focus: April 24, 2025

- Reliance Industries: Up 2% pre-market after announcing a green energy JV with Siemens.

- HUL: Faces selling pressure amid margin concerns despite dividend announcement.

- Adani Ports: In spotlight as cargo volume growth hits a 12-month high.

- Zomato: Expected to rally on strong food delivery GMV guidance.

Expert Views and Strategy

- Swastika Investmart: “Nifty needs to sustain above 23,800 for a rally. Buy dips in banking and infra stocks.”

- Morgan Stanley: “Sensex may touch 80,000 by May 2025 if earnings sustain 18% YoY growth.”

- Retail Investor Tip: Avoid aggressive bets ahead of the Fed meeting; focus on defensive sectors like FMCG and pharma.

Economic Data and Events to Monitor

- India’s GST Collections (April): Expected to cross ₹1.9 lakh crore, boosting fiscal optimism.

- US GDP Data (Q1 2025): Forecast at 2.4%; a miss could dampen global sentiment.

- Rupee Movement: Stable at 82.8/USD, but FII flows remain critical.

Sector-Wise Outlook for April 24

- Banking & Financials: Bullish (Rate-sensitive stocks may gain on RBI’s dovish tilt).

- IT: Neutral (Wait for NASDAQ direction).

- Metals: Bearish (China’s demand worries linger).

- Real Estate: Bullish (Affordable housing push in Union Budget).

Risk Factors to Consider

- Valuation Concerns: Nifty’s P/E at 24x vs. 10-year average of 20x signals overvaluation risks.

- FII Pullout Fears: Rising US bond yields could trigger capital outflows.

- Geopolitical Surprises: Escalation in Russia-Ukraine conflict remains a wildcard.

Conclusion: Trade Strategy for April 24, 2025

The Nifty 50 and Sensex are poised for a cautiously optimistic start, supported by strong earnings and FII inflows. However, global macro risks and profit-booking at higher levels may cap gains. Traders should:

- Go Long in banking, auto, and green energy stocks.

- Book Profits in overvalued midcaps.

- Set Stop-Losses at 23,600 (Nifty) and 78,000 (Sensex).

Long-term investors can accumulate quality large-caps on dips, focusing on sectors aligned with India’s GDP growth story.

Pingback: How Trump’s Confrontational Stance Forged Unlikely Unity ...